Accounts Receivable Are Best Described as

Receivables arising from sales to customers are best described as. As already mentioned Accounts Receivable is the asset of a company that describes the money customers owe your business.

Should Accounts Receivable Be Considered An Asset Billtrust

Accounts receivable is an asset as it both represents the amount owed by the customer to a business and is convertible to cash at a future time.

. When an entity factored accounts receivable without recourse with a bank the transaction is best described as a. Accounts receivable describes money that your business is owed from its customers or clients. An account receivable is documented through an invoice which the seller is responsible for issuing to the customer through a billing procedure.

Factoring accounts receivable means selling receivables both accounts receivable and notes receivable to a financial institution at a. The entity received cash as a result of this transaction which is best described as. Accounts receivable are best described as.

Which of the following best describes accounts receivable. If a company has. The Balance Maddy Price.

Liabilities of the company that represent the amount owed to suppliers. The transferor maintains continuing. This unpaid invoice describes the sale of.

When the accounts receivable of a company are sold outright to a company that normally buys AR the accounts receivable are said to have been. Accounts receivable are best described as. Accounts receivable AR are the amounts owed by customers for goods or services purchased on credit.

Amounts that have previously been received from. Accounts Receivable is an asset account on your balance sheet that literally means money that has not yet been received such as something bought on credit or. Gar received cash as a result of this transaction which is best described as a.

Accounts Receivable AR is the proceeds or payment which the company will receive from its customers who have purchased its goods services on creditUsually the credit period. In your personal life an example of Accounts Receivable. Correctly managing your AR can help you reduce cash flow problems improve investment and.

Accounts receivable is any amount of money your customers owe you for goods or services they purchased from you in the past. Accounts receivable sometimes shortened to receivables or AR is money owed to a company by its customers. Accounts receivable are documented through outstanding invoices which you as seller are responsible for issuing to the customer.

Definition and explanation. In retail each transaction is paid for immediately. Accounts receivable is best managed on a consistent and routine basis.

Loan from Ross to be repaid by the proceeds from. Select one or more. An entity factored accounts receivable without recourse with a bank.

Accounts Receivable software is a helpful. If a receivable account has. The invoice describes the.

This money is typically collected after a few weeks and is recorded as an asset on your companys balance sheet. Bank loan collateralized by the accounts receivable. 5 tips to help you stay on top of accounts receivable.

Amounts that have previously been received from customers. The money owed to the company is called accounts receivable. Liabilities of the company that represent the amount owed to suppliers.

Accounts Receivable AR refers to the outstanding invoices a company has or the money it is owed from its clients. On most company balance. Finance questions and answers.

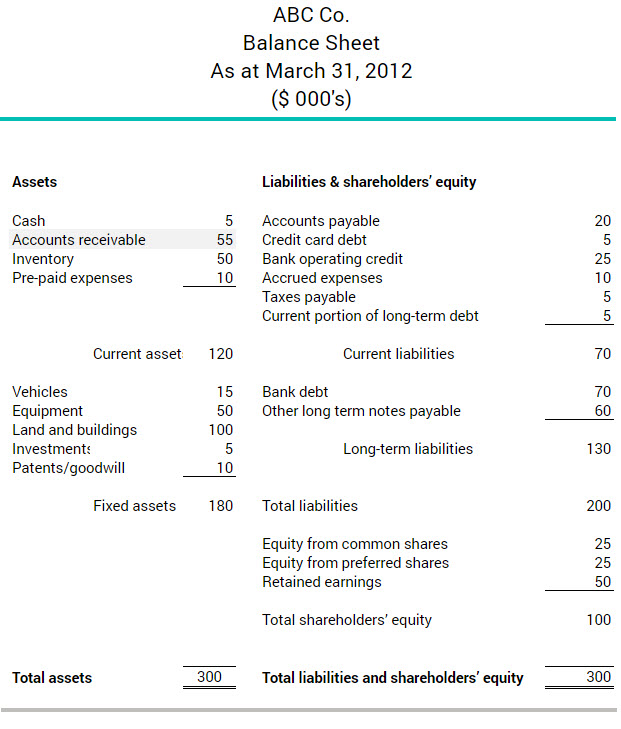

As you know accounts receivable is the amount that is yet to be received from your customers within a defined period usually a short period thus it is treated as current. Accounts receivable AR is the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers. Assets of the company representing the amount owed by customers.

Loan from Ross collateralized by Gars accounts receivable.

Accounts Receivable Double Entry Bookkeeping

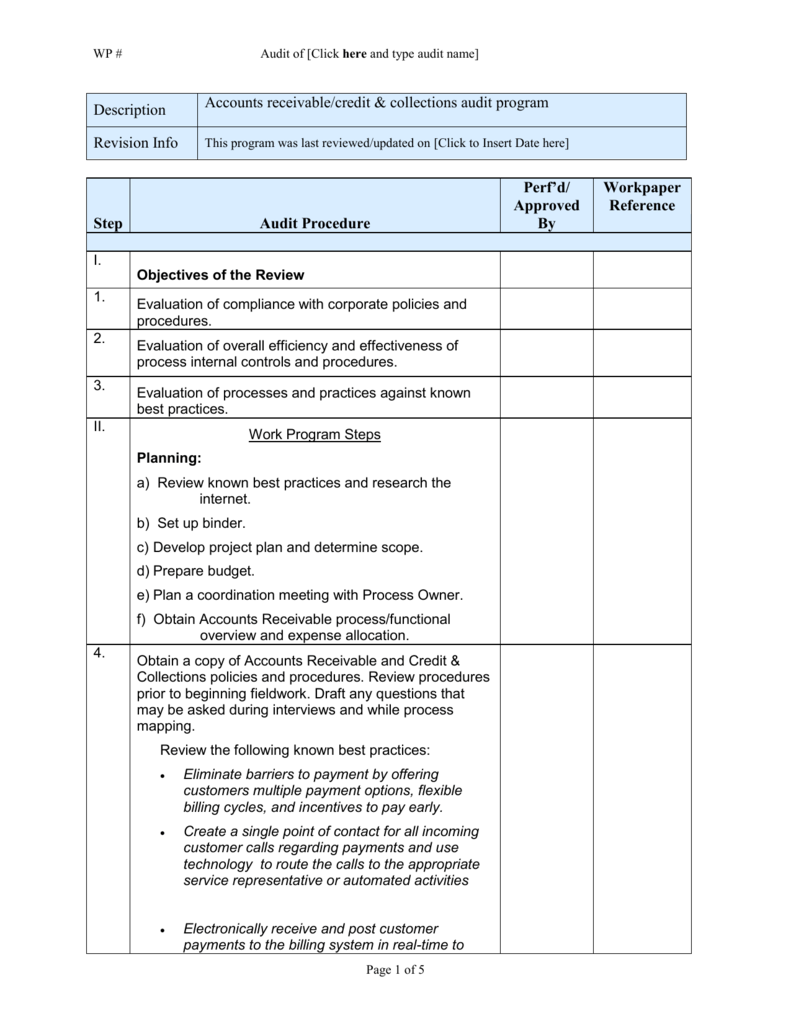

Accounts Receivable And Collections Audit

Comments

Post a Comment